|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Refinance Rates vs Mortgage Rates: Key Differences and ConsiderationsWhen navigating the complex world of home financing, understanding the nuances between refinance rates and mortgage rates is crucial. Both play significant roles in homeownership, but they serve different purposes and can impact your financial strategy in unique ways. What Are Mortgage Rates?Mortgage rates are the interest rates applied when you first purchase a home. They are determined by several factors including your credit score, the type of loan, and the current economic environment. Factors Influencing Mortgage Rates

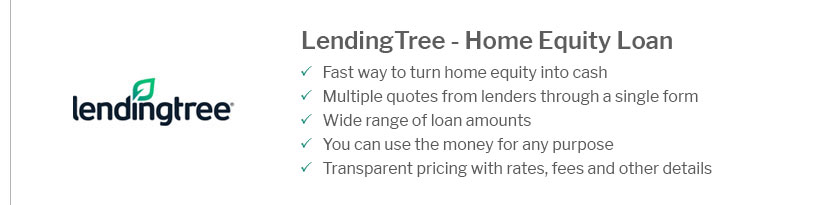

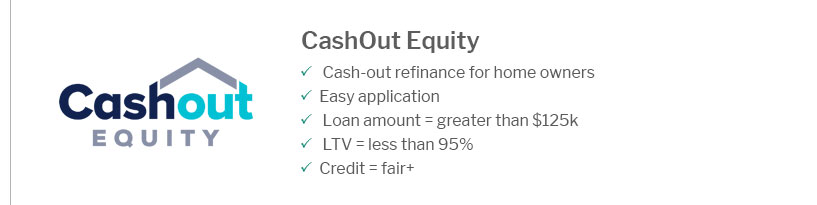

These rates are pivotal as they determine the monthly payment and total cost over the life of the loan. Understanding Refinance RatesRefinance rates apply when homeowners decide to revise their existing mortgage terms. This could be to take advantage of lower interest rates, change loan duration, or switch from an adjustable-rate to a fixed-rate mortgage. Reasons to Consider Refinancing

However, refinancing isn't always the best choice. Explore the reasons not to refinance your home to make an informed decision. Comparing Refinance and Mortgage RatesWhile both rates impact your financial strategy, refinance rates often differ from initial mortgage rates. Key differences include:

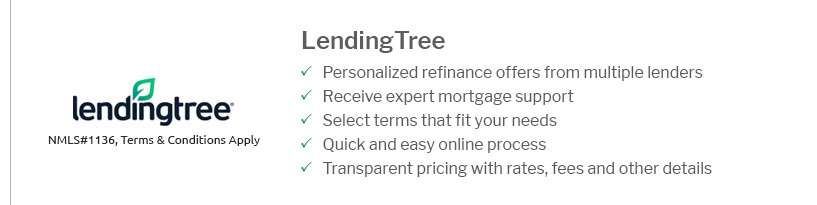

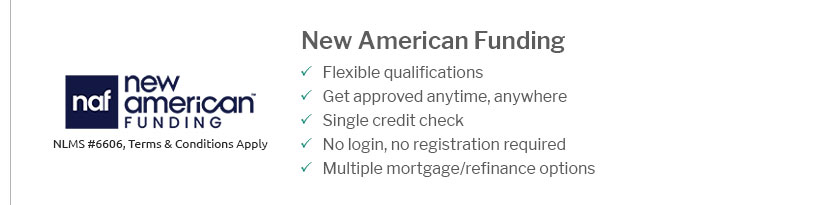

Considering options like a va home loan refinance can provide benefits unique to veterans. FAQ SectionWhat is the current trend in refinance rates?Current trends in refinance rates fluctuate based on economic conditions, Federal Reserve policies, and housing market dynamics. It's essential to monitor these trends regularly. How can I determine if refinancing is right for me?To decide if refinancing is right for you, consider your current interest rate, loan term, financial goals, and the costs associated with refinancing. Consulting with a financial advisor can also provide personalized insights. Do refinance rates vary by lender?Yes, refinance rates can vary significantly by lender due to differences in fees, loan products offered, and customer service levels. It's advisable to shop around and compare rates from multiple lenders. https://www.bankrate.com/mortgages/refinance-rates/

Mortgage rates remain above 7 percent, and that means refinancing just doesn't make sense for many borrowers, who are opting for home equity loans or home ... https://www.reddit.com/r/Mortgages/comments/1f2mghp/are_refi_rates_higher_than_mortgage_rates/

For conventional loans, unless you have perfect credit and an awful lot of equity, there are upward adjustments to rate - the more equity and ... https://www.cbsnews.com/news/what-are-todays-mortgage-and-mortgage-refinance-interest-rates/

What are today's mortgage and mortgage refinance rates? - 15-year mortgage: 6.39% - 30-year mortgage: 7.11%.

|

|---|